oregon tax payment plan

1 day agoMaine taxpayers with a federal adjusted gross income of less than. You will have to pay the settlement offer amount in full within 30 days or you may ask for a 12-month payment plan.

Egov Oregon Gov Dor Pertax 101 045 08

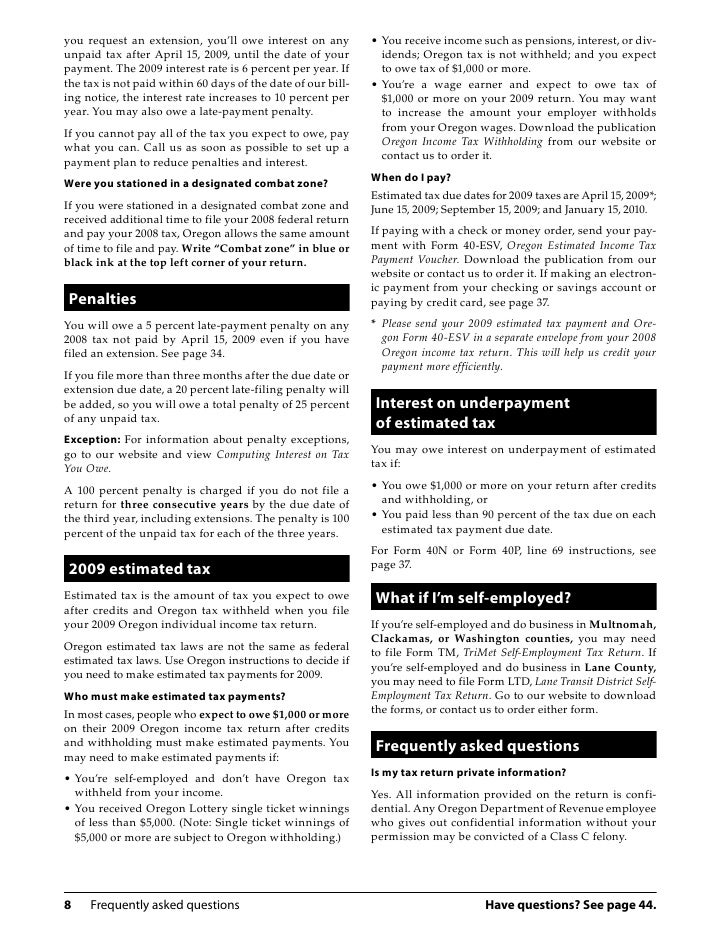

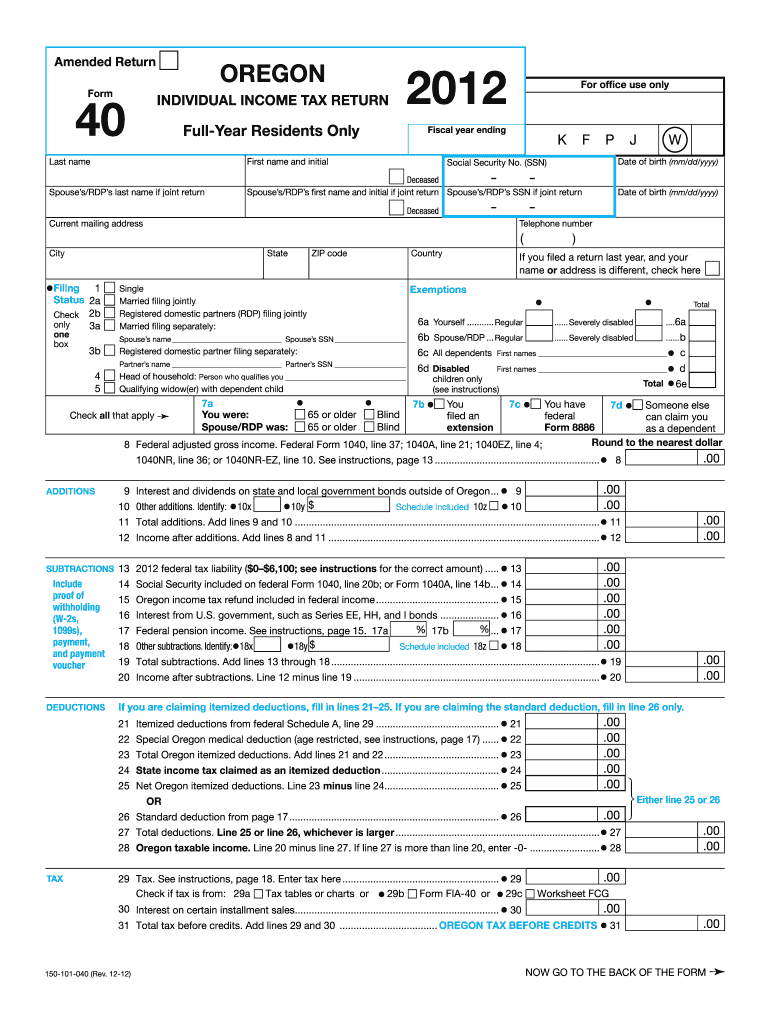

Electronic payment from your checking or savings account through the Oregon Tax Payment System.

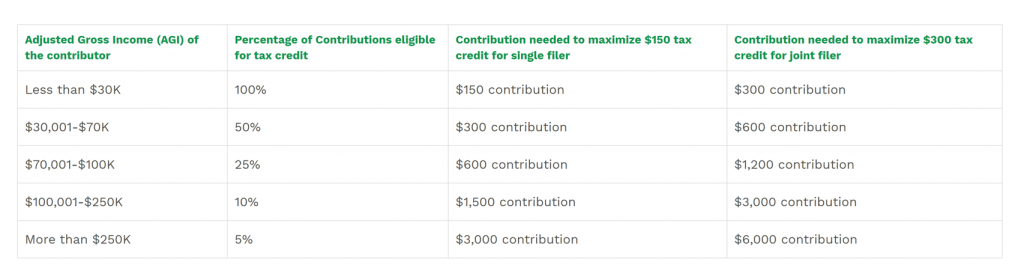

. Oregon levies a progressive state income tax system with one of the highest top rates in the US at 990. 100 Free Federal for Old Tax Returns. If you meet the governments low-income standards the fee for setting.

Ad Prepare your 2019 state tax 1799. EFT Questions and Answers. To electronically pay state payroll taxes including the WBF assessment by electronic funds transfer EFT use the Oregon Department of Revenues self-service site Revenue Online.

Complete Edit or Print Tax Forms Instantly. Be advised that this payment application has been recently updated. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

Owing money to the government can be frightening but were here to help you. As of January 1 2021 have paid all outstanding UI tax contributions and related liabilities including those determined in a payment plan accepted by the director of the Oregon. You will need to complete a three-year compliance period by filing and.

Even if youre unable to pay the entire tax bill you should. Once your transaction is processed youll receive a confirmation. Oregon Tax Payment Plan LoginAsk is here to help you access Oregon Tax Payment Plan quickly and handle each specific case you encounter.

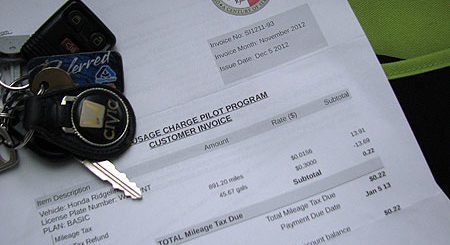

Overview of Oregon Taxes. File your tax return anyway to avoid penalties. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and.

The Tax Cuts and Jobs Act of 2018 added a cap on the federal State and Local Tax SALT deduction at the individual level of 10000. Your browser appears to have cookies disabled. The Oregon Small Business Development Center Network.

Furthermore you can find the Troubleshooting. Get Your No Obligation Analysis With Qualification Options. Copy of your Oregon tax return.

Since then many states with high individual. Ad Tax Relief for Business OwnersContractorsIndividuals Who Cant Pay Taxes Owed. Select a tax or fee type to view payment options.

The fee is based on the amount of your payment. 7 hours agoTyson Foods the countrys largest poultry producer will pay 105 million to settle allegations by Washington Attorney General Bob Ferguson that it conspired with other poultry. Prepare and file 2019 prior year taxes for Oregon state 1799 and federal Free.

Cookies are required to use this site. Download Or Email Form 40-ESV More Fillable Forms Register and Subscribe Now. Ad Help for Taxpayers Discover the options available to settle your tax debt.

The service provider will tell you the amount of the fee during the transaction. Oregon Tax Payment System Oregon Department of Revenue. If you use the online application but elect to make your payments by check or money order the fee is 149.

Ad Access Tax Forms. Cant pay it all. Ad Tax Relief for Business OwnersContractorsIndividuals Who Cant Pay Taxes Owed.

Get Your No Obligation Analysis With Qualification Options. The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and. SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal.

Ad Apply For Tax Forgiveness and get help through the process. Residents of the greater Portland metro.

Understanding The Oregon Corporate Activity Tax Wipfli

Financial Advisor For Tax Planning In Portland Oregon Interactive Wealth Advisors

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Tax Season 2022 Starts Strong Oregon Office Of Economic Analysis

State Tax Form 1040 Fill Online Printable Fillable Blank Pdffiller

Free Payment Plan Agreement Template Word Pdf Eforms

States Warn Of Budget Crunch Under Republican Tax Plan The New York Times

State Of Oregon Oregon Department Of Revenue Payments

Free Payment Plan Agreement Template Word Pdf Eforms

Solved Oregon Has An Income Tax But No State Sales Tax Chegg Com

Oregon Tax Forms 2021 Printable State Form Or 40 And Form Or 40 Instructions

8 Things To Know About Oregon S Tax System Oregon Center For Public Policy

Does Your State S 529 Plan Pay For Itself Morningstar

What S My Kicker Oregon Releases Plan For Tax Surplus Money Local Kezi Com

Federal Stimulus Could Mean Higher Oregon Tax Katu

Oregon Taxpayer Survey Results Oregon Tax News

8 Things To Know About Oregon S Tax System Oregon Center For Public Policy

Cannabis Taxes The Biden Plan The Oregon Plan And Your Bottom Line Canna Law Blog